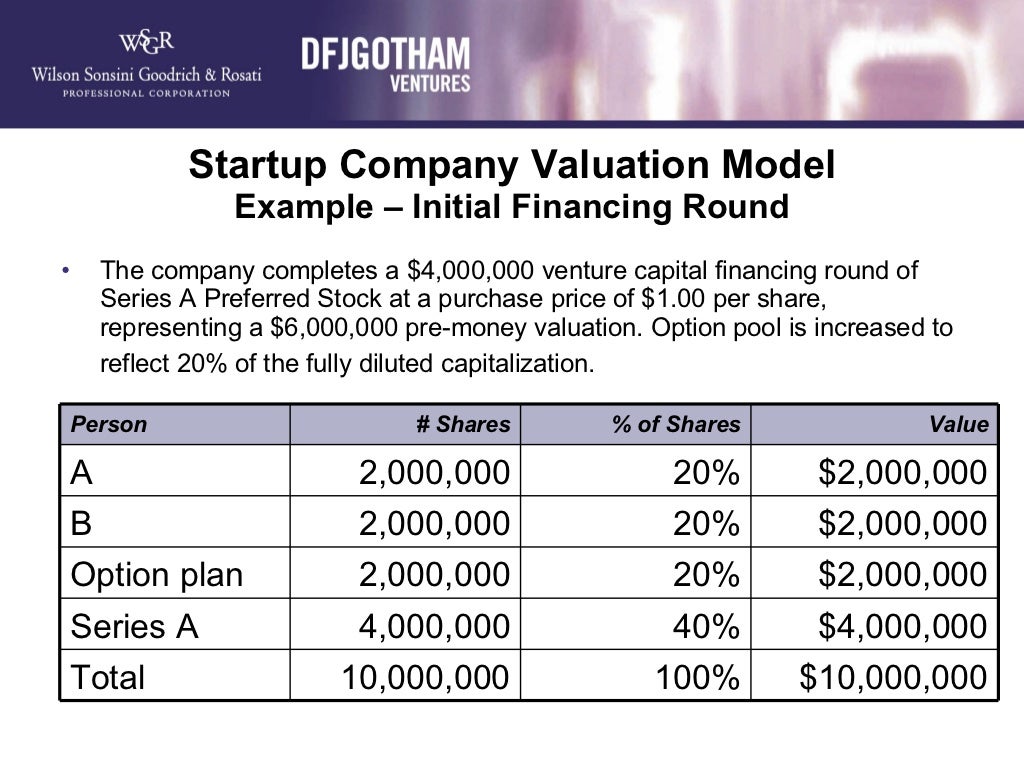

A typical allocation of shares might be: (i) issue 2,700,000 shares to Founder Alice, (ii) issue 2,700,000 shares to Founder Bob, (iii) issue 2,700,000 shares to Founder Charlotte, (iv) adopt a company stock plan with 1,000,000 shares reserved in the company stock plan, and (v) leave 900,000 shares unissued and available for future use.Ī startup that knows it intends to recruit additional co-founder(s) may decide to issue fewer than 8,000,000 shares to the initial founder(s), thereby leaving enough unissued shares available to issue to the future co-founder(s).Įxample: At formation, Founder Alice is the sole founder of Acme Co however, she intends to recruit an additional founder. has three co-founders who have agreed to equal ownership.

Company Stock Plan: Approximately 1,000,000 shares reserved in a company stock plan for future equity awards to employees, consultants, advisors and directors.Founders: Approximately 8,000,000 shares distributed among the founders according to their agreed upon ownership.Initial Equity AllocationĪt formation, a typical allocation of 10,000,000 authorized shares is: How do startups typically allocate shares at formation?Īt its initial formation, a typical Delaware startup authorizes 10,000,000 shares of common stock in its certificate of incorporation filed with the Delaware Secretary of State.

0 kommentar(er)

0 kommentar(er)